Are you planning to get a credit card in Japan to avoid incurring foreign transaction fees? Consider choosing among the four best credit cards in Japan for foreigners.

Although you heard about a Japan-issued credit card is difficult to obtain due to a stricter examination process compared to other countries, that does not mean you can’t have one.

In this article, we will help you make your application a lot easier by providing you with the most foreigner-friendly credit cards in Japan, as well as the steps on how you can apply online. And you will also learn some helpful tips to make your credit card application a successful one.

3 Best Credit Cards in Japan

To determine which card will suit your spending habits and needs, you have to dig into some details. To help you out, here’s the valuable information you want to know about the four best credit cards for foreigners in Japan. And the exciting enrollment offers you will enjoy once your application is successful.

1. American Express

Why choose American Express?

- Wide acceptance: American Express is one of the most widely accepted credit cards in Japan, particularly in Tokyo. This means you can use it at numerous merchants and establishments across the country.

- Online shopping safety: Amex offers unique protection services that enhance the security of online shopping and payment transactions. This can give you peace of mind when making online purchases or conducting financial transactions.

- Points accumulation: With American Express, you can earn points from your daily payments and shopping activities. These points can be accumulated and later transferred to various reward programs or redeemed for a range of benefits.

Earn a total of 41,000 points on Gold Membership Rewards!

- Accumulate 37,000 Bonus Points by spending 400,000 yen or more on your card within three months of joining.

- Regular Usage Points: 4,000 Bonus Points (100 yen = 1 point)

- Accessibility for foreign nationals: American Express allows foreign nationals living in Japan to apply for their credit card. This inclusivity makes it a suitable option for individuals from diverse backgrounds.

- Mobile app convenience: American Express provides a mobile app that allows for easy mobile banking. Through the app, you can conveniently check your card’s available balance, download usage statements, track your points, explore special deals, and enjoy other useful features.

Get American Express Gold Card Now!

Check out these amazing Amex gold features:

- Gold Dining by Invitation Hiyo: This service is designed for special occasions like birthdays and wedding anniversaries. With this feature, you can enjoy exclusive benefits at approximately 250 restaurants in Japan and overseas. When you make a reservation for a set course menu for two or more people, one person’s course meal charge will be complimentary.

- Comprehensive Insurance Services: As a Gold Card member, you gain access to unique insurance services. These services may include Smartphone Protection, Return Protection, Shopping Protection®, and more. These insurance benefits can provide added security and coverage for your purchases and personal belongings.

- Domestic Coupons for “The Hotel Collection”: As an ongoing benefit, Gold Card members receive domestic coupons for “The Hotel Collection.” This is a travel booking site that offers accommodations at various hotels and resorts. With the coupon, you can enjoy a discount of 15,000 yen when making a reservation for two nights or more at eligible domestic hotels.

- Starbucks Benefits: As a Gold Card member, you can also enjoy Starbucks benefits. This may include drink tickets worth 3,000 yen that can be redeemed at participating Starbucks locations.

2. Mitsui Sumitomo or SMBC Credit Card

Mitsui Sumitomo is the first Visa card in Japan.

Why choose Mitsui Sumitomo?

- This visa card has great enrolment benefits.

- It is safe and secure to use.

- With point service: 1 point for every 200 yen (tax included)

- Offers easy and convenient ways to pay. To enable the one-touch payment function, sync your credit card account with digital wallet services, such as Apple Pay, Google Pay, and Sumitomo Mitsui Card ID.

- The online application with an SMBC credit card will take to a minimum of 3 business days and about a week to get it via delivery service. Some cards can be issued the shortest next business day.

SMBC Credit Card Enrollment Offer

-

- Get points for the card enrollment month and 15% of the usage amount until the end of 2 months (up to 5,000 points)

- Get a gift code for 500 yen when syncing your account on Apple Pay or Google Pay

Steps to apply online:

-

- Enter application details.

- Set up a payment account on the Internet.

- Wait for the admission examination/card issuance (minimum of 3 business days)

- The card arrives at home (about a week or seven days)

Visit SMBC’s official website to learn more on how to apply.

Mitsui Sumitomo Visa Classic Card Official Page

3. Epos Card

Why choose Epos credit card?

- Epos is partnered with Global Trust Network (GTN), a guarantor company for foreigners in Japan. GTN Epos is a credit card specially designed for foreigners in Japan.

- NO admission fee and NO annual fee.

- Earn points and get special offers while purchasing at a physical store or online store. Epos points can be exchanged for: gift certificates, goods, and shopping discounts at Marui.

- You can use the card to pay utility bills such as mobile phones, electricity, and gas.

- GTN EPOS Card offers support in multiple languages

- Easy to apply, and the credit card can be issued within the day.

Epos Enrollment Offer

-

- A new member will receive 2,000 yen worth of EPOS Points.

Steps to apply online:

-

- Pick a card type and fill out the form.

- Check the notification e-mail of the examination status and result.

- Pick up at Epos Card center for the same-day issuance or receive it about a week through a delivery service.

For more details about how to get a credit card, visit the Epos Card official website.

Helpful Tips To Apply For A Credit Card in Japan

Tip 1: Know The 4 Must-Haves When Applying For A Credit Card in Japan

Knowing the must-have requirements is the first thing you should do before you begin your credit card application. It will help you understand if you are eligible to apply for and receive a credit card in Japan. The following are the four must-haves:

Having a Japanese Bank account.

Owning a bank account in Japan is the most important requirement of your credit card application. Without it, it would be difficult for you to process.

So if you have no bank account yet and planning to have one, it is best to look for an English-speaking or bilingual bank, such as the Japan Post Bank. This bank does not require foreign applicants to be fluent in Japanese. Besides, this bank is the owner of Yucho (ゆうちょ) – is an interbank network in Japan.

Once you’ve opened with JP Bank, you will likely receive a limited type, which allows you to receive direct deposits in Japan transfers. But to transfer funds to other banks or other transfer services leave you not permitted for the first six (6) months.

After six (6) months, you can apply to the bank to switch your account to a regular one to obtain transfer services.

Having all the required documents.

These documents are needed when you apply for a credit card in Japan. And these will also be used to check your length of stay in Japan, your address, and more. You must, therefore, have them ready before you begin your application.

- Residence Card

- Residence Certificate

- Parent/Legal Guardian’s Consent Letter (Required only for applicants aged 18 to 20)

*Students applicants are required to show a student identification (ID).

Having optional documents ready.

These documents are not required, but it would be better to have them ready during the application. And you can show them to the person processing your application if she/he will ask them.

- Passport – Your passport contains information that a bank wants to check. It may also serve as your identification.

- Insurance Card – Company insurance shows employment and income, which guarantees the credit card company that you can pay your debts.

- Credit Card Fees – You can also show them your health insurance if you have one.

- Phone Contract – A phone contract can also make an impact on your ability to obtain a credit card in Japan. It would be easier for them to contact you, and having a payment track record of your phone contract can boost your credit score.

- Income Statement – Your income statement is a record to show your capability to pay your future debts.

Having the ability to read and write in Japanese.

Knowing how to read and write in the Japanese language is necessary during the entire credit card application. Most credit card companies in Japan used it as the basis of credit card approval. Besides, you will need to fill out a Japanese application form that requires the applicant to write in Japanese.

Tip 2: Choose a Credit Card in Japan That is Best for Foreigners.

Take into consideration this tip when choosing a credit card to apply in Japan. Remember, most credit card companies in Japan have a strict examination process. So to ace credit card applications, you should carefully select those open for foreigners. Again, we highly recommend these four best credit cards in Japan.

-

- American Express

- Mitsui Sumitomo or SMBC Credit Card

- Epos Card

Tip 3: Know The Reasons For Failing Credit Card Screening

After you filled up the application online, then the company will conduct a screening. Unfortunately, many failed this process. However, if you understand the reasons beforehand, you might avoid arriving in the same scenario.

Let’s focus on these six points why many failed during the screening.

1. Work and income information

In compliance with the processing procedure, you allow them to examine your employment background and your income. Any of the details written in your application will most likely fail the screening process.

- “Unemployed” in the occupation column.

- A short length of service.

- Unbalanced income and expenditure

2. A short length of stay in Japan

The length of stay is another relevant detail a credit card issuer will investigate. If you stay in Japan for a minimum of six months to a year, most likely not be issued. Otherwise, you are employed in a prestigious company in Japan, with a high salary.

3. Bad Credit History

Your delinquency on loan payments from other banks will reflect your credit history. If the credit card company in Japan discovers your bad credit record, you will surely fail the screening process.

4. Multiple Card Applications

Applying to multiple credit cards will also damage your credit score. It gives them an impression that you are a riskier borrower compared to those who apply less often. Take note that multiple accounts with the same credit card are not allowed.

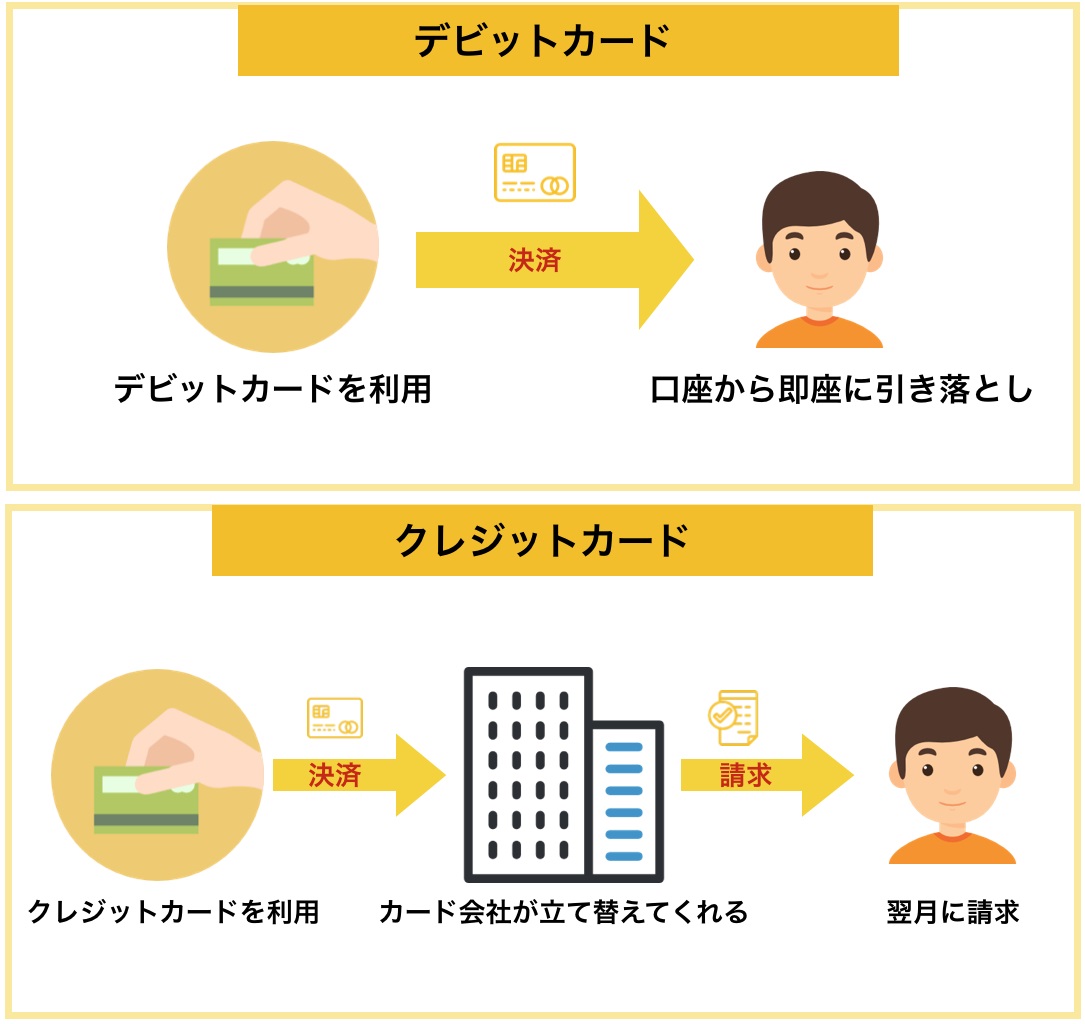

If NOT qualified to get a credit card in Japan, get a Debit Card!

Debit cards offer the convenience of a credit card but work differently. Using a debit card draws money directly from your bank account once you make a purchase. The debit card draws money directly from your bank account when you make the purchase. The amount of your purchase is placed on hold in your account and is then transferred to the store’s account after a transaction is confirmed.

How credit and debit cards work.

Benefits:

A debit card is convenient as having a credit card, except that you cannot borrow funds from the bank. Also, using it as a payment deducts money directly to your bank account. Thus, there are no interest charges. It is more convenient than carrying cash, too.

We recommend Japan Net Bank.

The card’s issuance and its yearly service fees are free. On top of it, foreigners are qualified to apply. The following are some benefits of having a Japan-issued Japan Net Bank debit card.

-

- Account summary can be seen online

- JNB Visa Debit Card has the best deal for points.

For every 500 Yen = 1 JNB Star

1 JNB Star = 1 Yen

Conclusion

While it may be challenging, foreigners can still obtain a credit card in Japan by applying for one of the best credit cards available. Make sure to choose a card that is easy to get approved for.

If you prefer a flexible credit card that can be used overseas and will not incur foreign transaction fees, go for an American Express credit card. However, among the three credit cards, we recommend the GTN Epos card. Aside from no annual fees, this card is exclusive to foreigners in Japan.

But if in case that your credit card application is unsuccessful, the best alternative is obtaining a debit card or a prepaid card. How can you get one in Japan? Read the “Prepaid Cards in Japan: What You Need to Know?” article to learn more.

To get assistance with your credit card application, you may check our Credit Card Support Service.

I tried to apply for credit card in different company but none of them are working as it’s because of name which we have to write in kanji where I am a foreigner, so I don’t know how to write my name in kanji. Please help me to solve this problem. Thank you.

Thank you for the comment!

Credit companies should accept name in katakana and Hiragana.

Did you try it? If not, you should try it.

I hope it could solve problem.

Thank you.

I don’t how write kanji and katakana and hiragana